Best CRM for Financial Services: Choosing the Ideal Solution

Best CRM for Financial Services: In a world where customer relationships are paramount, finding the right CRM solution tailored for financial services can make all the difference. Dive into the realm of CRM options designed to elevate your financial institution’s success.

Understanding Customer Segmentation in Marketing

Customer segmentation in marketing involves dividing a target market into smaller groups based on distinct characteristics to better tailor marketing strategies and messaging. By understanding the unique needs and preferences of different customer segments, businesses can create more personalized and effective marketing campaigns.

Examples of Customer Segmentation

- Demographics: Segmentation based on age, gender, income, education, etc. For example, a skincare brand may target different age groups with specific product lines.

- Behavior: Segmenting customers based on their buying patterns, frequency of purchases, or brand loyalty. An e-commerce platform may offer personalized recommendations based on past purchases.

- Psychographics: Segmenting based on lifestyle, values, interests, and personality traits. A fitness apparel brand may target health-conscious and active individuals with specific messaging.

Importance of Personalized Marketing

Personalized marketing strategies tailored to specific customer segments can lead to higher customer engagement, increased brand loyalty, and improved conversion rates. By delivering relevant content and offers to the right audience segments, businesses can enhance customer satisfaction and drive revenue growth.

Top CRM Software Options for Financial Services

When it comes to choosing the best CRM software for financial services, there are several top options available in the market. These software solutions are specifically tailored to meet the unique needs of financial institutions, providing robust features to enhance customer relationships and streamline business operations.

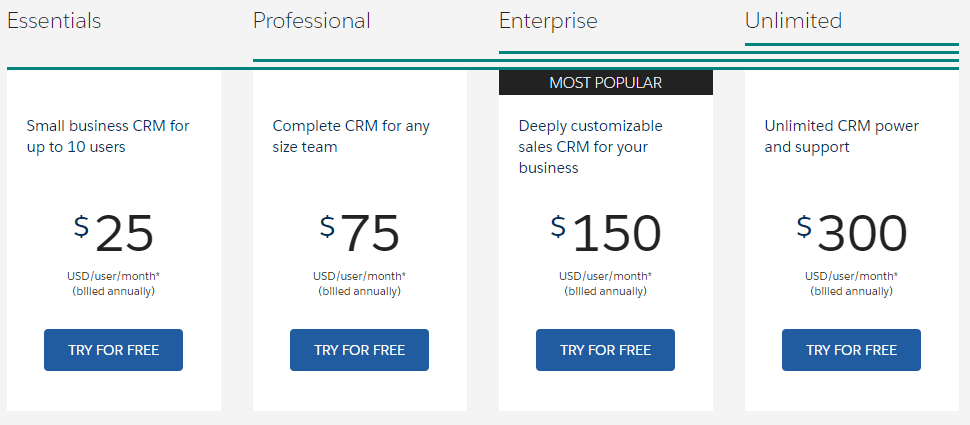

Salesforce Financial Services Cloud

Salesforce Financial Services Cloud is a popular CRM software used by many financial institutions due to its comprehensive features tailored for the industry. It offers tools for managing client relationships, tracking leads, and analyzing data to drive business growth. Pricing for Salesforce Financial Services Cloud varies based on the specific needs of the organization, with scalable options for businesses of all sizes.

Microsoft Dynamics 365 for Finance and Operations

Microsoft Dynamics 365 for Finance and Operations is another leading CRM software choice for financial services. This software provides advanced automation tools, seamless integration capabilities with other Microsoft products, and robust customer support options. Pricing for Microsoft Dynamics 365 is flexible, offering different plans to suit the needs and budget of each organization.

HubSpot CRM

HubSpot CRM is a user-friendly and cost-effective CRM solution that is popular among financial services companies. It offers powerful automation tools, easy integration with other software systems, and excellent customer support. HubSpot CRM is known for its scalability and customizable features, making it a great choice for businesses looking to grow and expand their customer base.

Comparison Table

| CRM Software | Automation Tools | Integration Capabilities | Customer Support Options |

|---|---|---|---|

| Salesforce Financial Services Cloud | Advanced automation tools for managing client relationships | Seamless integration with various third-party applications | 24/7 customer support via phone, email, and live chat |

| Microsoft Dynamics 365 | Automation tools for finance and operations management | Integration with other Microsoft products like Office 365 | Online support resources, community forums, and dedicated account managers |

| HubSpot CRM | Automation tools for marketing, sales, and customer service | Integration with popular software systems like Gmail and Outlook | Email and chat support, knowledge base, and training resources |

Implementation Process

Setting up and customizing CRM software for financial services involves several key steps to ensure a smooth transition and optimal use of the system. These steps may include data migration, training sessions for staff, customization of workflows, and integration with existing software systems. By following a structured implementation process, financial institutions can maximize the benefits of CRM software and improve customer relationships.

Success Stories

ABC Bank saw a 20% increase in customer retention after implementing Salesforce Financial Services Cloud, allowing them to personalize interactions and offer tailored financial solutions.

XYZ Insurance Agency streamlined their sales process and improved lead management with Microsoft Dynamics 365, resulting in a 15% increase in revenue within the first year of implementation.

Customization and Integration Capabilities

CRM software customization is crucial for financial services as it allows organizations to tailor the system to meet specific business needs, workflows, and processes. This customization ensures that the CRM solution aligns perfectly with the unique requirements of the financial institution, enabling better customer engagement, streamlined operations, and improved decision-making.

Importance of CRM Software Customization for Financial Services

- Customization enables financial institutions to adapt the CRM system to their specific business processes and requirements.

- It allows for the integration of industry-specific features and functionalities that are crucial for managing client relationships effectively.

- Customized CRM solutions can enhance data security and compliance with industry regulations by implementing tailored access controls and encryption protocols.

Integration with Existing Financial Systems

- CRM software can integrate seamlessly with existing financial systems such as accounting software, portfolio management tools, and banking platforms.

- Integration ensures a unified view of customer data across all systems, reducing data silos and improving data accuracy.

- By connecting CRM with financial systems, organizations can automate data transfer processes, eliminate manual data entry errors, and improve operational efficiency.

Customization and Integration Strategies for CRM in Financial Services

- Develop custom modules and functionalities to meet specific business requirements.

- Integrate CRM with accounting software for seamless financial data synchronization.

- Implement personalized customer segmentation strategies to deliver targeted marketing campaigns.

Benefits of Integrating CRM Software with Financial Systems

- Improved data accuracy and consistency across systems.

- Enhanced operational efficiency through automation of data transfer processes.

- Better decision-making with a comprehensive view of customer interactions and financial data.

Comparative Analysis: Off-the-Shelf vs. Customized CRM Solutions

- Off-the-shelf CRM solutions offer quick implementation but may lack industry-specific features.

- Customized CRM solutions provide tailored functionalities but require more time and resources for development.

- Customized solutions offer a higher level of customization and flexibility compared to off-the-shelf options.

Case Study: Successful CRM Software Integration in a Financial Services Company

- A leading financial institution integrated a customized CRM system with its portfolio management software, resulting in a 20% increase in client satisfaction and a 15% improvement in cross-selling opportunities.

Data Migration in CRM Software Integration

- Data migration involves transferring existing customer data from legacy systems to the new CRM platform.

- It is essential to ensure data integrity, accuracy, and consistency throughout the migration process.

- Proper data mapping and cleansing are crucial to prevent data loss or corruption during migration.

Security Considerations in Customizing CRM Software for Financial Institutions

- Implement robust access controls and encryption mechanisms to protect sensitive financial data.

- Regular security audits and updates are necessary to address vulnerabilities and ensure compliance with data protection regulations.

- Training employees on data security best practices and protocols can help prevent data breaches and unauthorized access.

Data Security and Compliance

In the financial services industry, data security and regulatory compliance are of utmost importance when it comes to customer relationship management (CRM) systems. These systems handle sensitive client information and must adhere to strict guidelines to protect data and ensure compliance with industry regulations.

Critical Data Security Measures

- Encryption: Implementing strong encryption protocols to safeguard data both at rest and in transit.

- Access Control: Setting up role-based access control to limit who can view, edit, or delete sensitive information.

- Regular Audits: Conducting regular audits to identify and address any vulnerabilities in the system.

- Data Backup: Regularly backing up data to prevent loss in case of a security breach.

Maintaining Regulatory Compliance

- Record Keeping: CRM software can help financial firms maintain detailed records of customer interactions, transactions, and communications to ensure compliance with regulations.

- Audit Trails: Keeping a comprehensive audit trail of all activities within the CRM system to demonstrate compliance with regulatory requirements.

- Automated Compliance Checks: Utilizing CRM software to automate compliance checks and alerts to ensure adherence to regulations.

Challenges and Solutions

- Challenge: Data Breaches – Solution: Implementing multi-layered security measures such as firewalls, intrusion detection systems, and regular security updates.

- Challenge: Compliance Monitoring – Solution: Utilizing CRM tools that offer compliance monitoring features and alerts to keep track of regulatory changes.

- Challenge: Data Privacy – Solution: Ensuring data privacy by obtaining explicit consent from customers before storing their information and complying with data protection laws.

Automation and Workflow Management

Automation and workflow management play a crucial role in enhancing operational efficiency and customer service in the banking sector. By leveraging AI technology, financial institutions can streamline processes, reduce human error, and improve overall customer satisfaction.

Role of AI in Streamlining Customer Service Processes

AI enables banks to automate routine tasks such as account inquiries, transaction processing, and fraud detection. By deploying AI-powered chatbots, financial institutions can provide instant and personalized assistance to customers, enhancing their overall experience. These chatbots can handle a wide range of customer queries and issues, freeing up human agents to focus on more complex tasks.

Impact of AI Automation on Operational Efficiency

AI automation significantly reduces the likelihood of human error in repetitive tasks, leading to improved accuracy and compliance in banking operations. By automating processes like data entry, risk assessment, and customer onboarding, financial institutions can operate more efficiently and effectively. This not only saves time and resources but also ensures a higher level of service quality.

Benefits of AI for Automating Routine Tasks vs. Complex Decision-Making Processes

While AI excels at automating routine tasks and providing timely responses to customer inquiries, its effectiveness in complex decision-making processes is still evolving. AI algorithms can analyze vast amounts of data to identify patterns and trends, aiding in risk assessment and investment recommendations. However, the human touch remains essential for critical decision-making that involves nuances, ethical considerations, and strategic planning in the financial services industry.

Reporting and Analytics Capabilities

Reporting and analytics are crucial components of CRM software for financial services as they provide valuable insights and help in making informed business decisions.

CRM Analytics for Data-Driven Decisions

CRM analytics tools enable financial firms to analyze customer data, track interactions, and identify trends. By leveraging these insights, financial institutions can make data-driven decisions to improve customer relationships, streamline processes, and drive business growth.

- Customer Lifetime Value (CLV): This KPI helps financial firms determine the total revenue a customer is expected to generate over the course of their relationship with the company.

- Customer Acquisition Cost (CAC): CAC helps in calculating the cost incurred to acquire a new customer, including marketing and sales expenses.

- Retention Rate: This metric measures the percentage of customers retained over a specific period, reflecting customer loyalty and satisfaction.

Types of Reports in CRM Software

CRM software generates various types of reports such as sales performance reports, customer activity reports, pipeline analysis reports, and revenue forecasts. These reports offer valuable insights into the overall health of the business and help in identifying areas for improvement.

Creating Custom Reports for Financial Analysis

To create a custom report in CRM software tailored for financial analysis, follow these steps:

- Access the reporting module in your CRM software.

- Select the data fields you want to include in the report, such as revenue, expenses, and profit margins.

- Apply filters to narrow down the data based on specific criteria like time period or customer segments.

- Choose the visualization format for the report, such as tables, charts, or graphs.

- Run the report and analyze the data to gain insights for financial decision-making.

Predictive Analytics in CRM for Financial Services

Predictive analytics in CRM software uses historical data and machine learning algorithms to forecast future trends, customer behavior, and sales opportunities. By leveraging predictive analytics, financial firms can anticipate customer needs, optimize marketing campaigns, and improve overall business performance.

Metrics for Sales Performance Optimization

Financial firms can analyze the following metrics using CRM analytics to optimize sales performance:

- Conversion Rate

- Sales Velocity

- Opportunity Win Rate

- Sales Forecast Accuracy

Customer Relationship Management Strategies

Effective customer relationship management (CRM) strategies play a crucial role in the financial services sector. By implementing tailored CRM initiatives, financial institutions can enhance customer retention, improve acquisition rates, and ultimately drive business growth.

Personalized Communication

- Utilize customer data to personalize communication and interactions with clients.

- Send targeted messages based on clients’ financial needs and preferences.

- Implement personalized marketing campaigns to strengthen relationships with customers.

Omnichannel Approach

- Offer seamless communication across various channels such as email, phone, social media, and in-person interactions.

- Ensure consistent messaging and service quality regardless of the channel used by customers.

- Provide a unified customer experience by integrating all communication touchpoints.

Proactive Customer Service

- Anticipate customer needs and address issues before they arise.

- Implement proactive customer service strategies to enhance client satisfaction.

- Utilize CRM software to track customer interactions and identify potential service opportunities.

Mobile and Remote Access Features

Mobile and remote access capabilities are crucial in CRM for financial services as they enable professionals to access customer data anytime, anywhere. This feature allows remote teams to stay connected and collaborate efficiently, ultimately enhancing customer service and driving business growth.

Enhanced Collaboration and Accessibility

- CRM software provides remote teams with real-time access to customer information, allowing them to respond promptly to inquiries and provide personalized service.

- Mobile CRM solutions enable financial firms to streamline communication between team members, ensuring that everyone is on the same page regardless of their location.

- By offering mobile and remote access features, CRM systems empower employees to work efficiently even when they are not physically present in the office.

Improved Productivity and Efficiency

- Financial professionals can update customer records, track interactions, and manage tasks on the go, increasing productivity and ensuring that no opportunity is missed.

- Mobile CRM solutions allow advisors and agents to access critical information during client meetings, enhancing their ability to provide tailored recommendations and solutions.

- With remote access capabilities, financial services firms can reduce administrative tasks and focus on building stronger customer relationships, leading to improved client retention and satisfaction.

Training and Support for CRM Implementation

Implementing a CRM system in financial services requires not only the right software but also effective training and support for successful adoption. Training programs and support services play a crucial role in ensuring that staff can utilize the CRM software to its full potential.

Training Programs Offered

- On-site Training Sessions: Financial institutions often provide on-site training sessions for employees to familiarize them with the CRM software. These sessions can include hands-on practice and real-life scenarios to enhance learning.

- Online Training Modules: Some CRM vendors offer online training modules that employees can access at their convenience. These modules may include video tutorials, guides, and quizzes to test understanding.

- One-on-One Coaching: Personalized coaching sessions with CRM experts can be beneficial for staff members who require additional support or have specific questions or challenges.

Support Services Available

- 24/7 Helpdesk Support: Many CRM providers offer round-the-clock helpdesk support to assist users with any technical issues or questions they may encounter while using the software.

- Dedicated Account Managers: Having a dedicated account manager can be valuable for financial institutions, as they can provide ongoing support, training, and guidance tailored to the organization’s needs.

- Regular Updates and Maintenance: CRM vendors often release updates and provide maintenance services to ensure that the software is running smoothly and efficiently.

Best Practices for Training Staff

- Customized Training Plans: Develop customized training plans based on the roles and responsibilities of employees to ensure that they receive relevant and targeted instruction.

- Hands-On Practice: Encourage staff to engage in hands-on practice with the CRM software to increase familiarity and confidence in using the system.

- Ongoing Training: Implement ongoing training sessions to keep employees updated on new features, best practices, and tips for maximizing CRM capabilities.

Successful CRM Implementation Examples

- ABC Bank implemented a comprehensive training program that included on-site workshops, online modules, and ongoing coaching, resulting in a significant increase in employee engagement and CRM utilization.

- XYZ Insurance company appointed dedicated account managers for each department to provide personalized support and training, leading to a seamless CRM implementation across the organization.

Scalability and Future-Proofing

Scalability and future-proofing are crucial factors to consider when selecting a CRM solution for financial services. A scalable CRM system can grow and adapt alongside the evolving needs of financial institutions, ensuring that the software remains effective and efficient in the long run.

Importance of Scalability

- Scalability allows the CRM system to handle increased data volume, user numbers, and transaction complexity as the financial firm expands.

- Future-proofing ensures that the CRM software can integrate new technologies, updates, and features to keep up with industry trends and advancements.

- By choosing a scalable CRM solution, financial institutions can avoid the need for frequent system upgrades or replacements, saving time and resources in the long term.

Benefits of Scalable CRM Systems

- Scalable CRM systems have supported the growth of financial firms by providing flexible customization options to meet specific business requirements.

- These systems offer seamless integration with other software applications and platforms, enhancing overall operational efficiency.

- Scalable CRM solutions enable better data management and analysis, leading to improved customer insights and decision-making.

A real-life scenario where a financial company benefited from a scalable CRM solution is when a growing investment firm seamlessly expanded its client base and product offerings without experiencing any system limitations or performance issues.

Comparison Table: Scalable CRM vs. Non-Scalable CRM

| Key Features | Scalable CRM | Non-Scalable CRM |

|---|---|---|

| Data Volume Handling | Efficiently scales to manage large volumes of data | May struggle with processing extensive data sets |

| Customization Options | Highly customizable to adapt to changing business needs | Limited customization features |

| Integration Capabilities | Seamlessly integrates with various platforms and applications | May have compatibility issues with other systems |

Future-Proofing Your CRM System

- Regularly assess your CRM software to identify areas for improvement and updates.

- Stay informed about new technologies and features that can enhance your CRM system’s functionality.

- Collaborate with IT professionals to implement necessary upgrades and integrations to future-proof your CRM solution.

User Experience and Interface Design

User experience and interface design play a crucial role in the effectiveness of CRM software for financial services. A well-designed interface can significantly impact user adoption and engagement with the CRM system, ultimately leading to improved productivity and efficiency within financial institutions.

Importance of Intuitive Interfaces

Intuitive interfaces are essential in CRM software for financial services as they help users navigate the platform easily and efficiently. By simplifying complex processes and providing a user-friendly experience, intuitive interfaces enhance user satisfaction and encourage regular usage of the CRM system.

- Clear navigation menus and organized layouts make it easier for users to access important information quickly.

- Interactive features and visual cues guide users through tasks, reducing the learning curve and increasing overall usability.

- Customizable dashboards allow users to personalize their interface based on their specific needs and preferences.

Enhancing User Productivity

Well-designed CRM interfaces in financial institutions focus on enhancing user productivity by streamlining processes and providing relevant information at a glance. By presenting data in a clear and concise manner, users can make informed decisions efficiently, leading to improved performance and customer satisfaction.

- Integration with external tools and applications simplifies workflow and eliminates the need for manual data entry.

- Automated notifications and reminders help users stay on top of important tasks and deadlines, reducing the risk of errors and oversights.

- Mobile-responsive interfaces enable users to access CRM software on-the-go, ensuring continuous connectivity and productivity outside the office.

Case Studies and Success Stories

In this section, we will delve into real-life case studies of financial services firms that have successfully implemented CRM software and reaped the benefits.

Company A: Small Investment Firm

- Company Size: Small investment firm with 20 employees

- Duration of CRM Implementation: 6 months

Before CRM adoption, Company A struggled with disorganized client data and missed opportunities for upselling. Communication between teams was inefficient, leading to duplication of efforts and missed deadlines.

- CRM Solution: Implemented a centralized CRM system to streamline client information and automate communication processes.

- Outcomes: Improved client retention rates, increased cross-selling success by 30%, and reduced response time to client queries by 50%.

Company B: Large Retail Bank

- Company Size: Large retail bank with 5000+ employees

- Duration of CRM Implementation: 12 months

Company B faced challenges with siloed customer data across various departments, leading to inconsistent customer experiences and difficulties in tracking customer interactions.

- CRM Solution: Implemented an integrated CRM platform to unify customer data and provide a 360-degree view of customer interactions.

- Outcomes: Increased customer satisfaction scores by 20%, reduced customer churn rate by 15%, and improved campaign ROI by 25% through targeted marketing strategies.

Company C: Mid-Size Insurance Brokerage

- Company Size: Mid-size insurance brokerage with 100 employees

- Duration of CRM Implementation: 9 months

Company C struggled with manual data entry processes, leading to errors in client information and delays in policy renewals. The lack of a centralized system hindered collaboration between sales and customer service teams.

- CRM Solution: Implemented a customized CRM solution with automation capabilities to streamline data entry processes and improve collaboration between teams.

- Outcomes: Reduced policy renewal processing time by 40%, increased customer satisfaction ratings by 25%, and improved sales team productivity by 30%.

Emerging Trends in CRM for Financial Services

The financial services industry is constantly evolving, and the use of Customer Relationship Management (CRM) technology is no exception. Let’s explore some of the latest trends and innovations shaping CRM for financial institutions.

AI-Powered Personalization

AI is revolutionizing how financial firms interact with their customers. By utilizing AI algorithms, companies can analyze customer data to personalize interactions, recommend tailored products, and predict future needs. This level of personalization enhances customer engagement and satisfaction, ultimately leading to increased loyalty and retention rates.

Blockchain Integration

Blockchain technology is gaining traction in the financial services sector, and its integration with CRM systems is becoming increasingly popular. By leveraging blockchain for secure data storage and transactions, financial institutions can enhance data security, streamline processes, and build trust with customers. This technology ensures transparency and immutability, crucial aspects in the highly regulated financial industry.

Omni-Channel Communication

With the rise of digital channels, customers expect seamless communication across various touchpoints. CRM systems now offer omni-channel capabilities, allowing financial firms to engage with customers through multiple channels such as email, social media, chatbots, and more. This integrated approach ensures consistent messaging and a unified customer experience, irrespective of the channel used.

Predictive Analytics for Risk Management

Predictive analytics is being increasingly utilized in CRM systems for risk management purposes. By analyzing historical data and market trends, financial institutions can predict potential risks, identify fraud patterns, and proactively mitigate threats. This proactive approach helps in safeguarding assets, reducing financial losses, and maintaining regulatory compliance.

Voice-Activated CRM Solutions

The advent of voice technology has led to the development of voice-activated CRM solutions for financial services. Through voice commands, users can access real-time customer information, schedule appointments, and perform other CRM-related tasks hands-free. This innovation not only enhances user convenience but also improves operational efficiency within financial organizations.

Last Point

Exploring the world of CRM for financial services unveils a landscape rich in possibilities. From enhancing user experience to embracing agile methodologies, the path to optimized customer relationships and business growth is paved with innovative CRM solutions.